How much can 1st time buyers borrow

For example a deposit of 20000 is worth 10 of a 200000 house so you. So if you were thinking of buying a property worth 150000 you would need to.

First Time Home Buyer Down Payment How Much Is Needed

This is known as the loan to value.

. The First Home Scheme Ireland 2022 allows first time buyers to borrow up to 30 of the value of their property directly from the government. This is due to the fact. The maximum debt to income ratio borrowers can have is 50 on conventional loans.

Conveyancing fees The legal work needed to add the new lender to the property title deeds. Each lender has its own slightly different way of underwriting and. These are known as 95 mortgages and your options could be restricted if you want one.

Typically first-time buyers are expected to put down a deposit of at least 10 in order to secure their mortgage. Top-Rated Mortgage Loans 2022. Fixed rate variable rate repayment or interest-only mortgages.

How much can I borrow as a first-time buyer. Several factors help the. Simply put a first time buyer is a person who has never taken out a mortgage for a property before.

For example lets say the borrowers salary is 30k. The hardship withdrawal option allows first-time home buyers to withdraw 10000 from their 401k without incurring the 10 IRS penalty. Stamp duty A tax paid on all property purchases over a specific price currently125k in.

It represents how much you need to borrow for a property after youve chipped in your deposit. To illustrate if youre buying a home worth 200000 and have a deposit of 25000 youll need to borrow 175000 to buy the home. So realistically most first-time home buyers need at least 3 down for a conventional loan or 35 for an FHA loan.

Under this scheme you can borrow 20 of the. In the case of a joint application both parties must be first time buyers to be eligible. Understand how mortgages work and get an official mortgage estimate.

Gifts or loans from relatives and programs like an 801010 combination loan can help you avoid PMI. Compare Lowest Mortgage Loan Rates Today in 2022. You to borrow up to 55 x your gross annual income after deducting your existing credit commitments.

Step 2 Calculate how much you can borrow. First-time Buyer Guide. When it comes to mortgages theres no one-size-fits-all answer to the question How much can I.

How much can a first time buyer borrow. A First Time Buyer mortgage is a very general term theres no specific product for new buyers. Theres zero interest for the first 5.

Lenders usually consider a deposit of 5 of the propertys value as a minimum. Available to first-time buyers and existing homeowners who want to buy a new build house. The purchase price must be no more than 600000.

801010 loans consist of a first mortgage 80 and a second mortgage 10 that total. Which mean that monthly budget with the proposed new housing payment cannot. However buyers will have to.

With the new help to buy scheme for first time buyers of new houses apartments and self builds a tax rebate of 10 upper limit of 30000 of the purchase price is potentially available on. Choose any type of mortgage. Basically the LVR is an expression of how much you plan to borrow versus the current value of the home.

Inovayt Pty Ltd ABN 25 126 141 982 Australian Credit License 391333 Inovayt Asset and Equipment Pty Ltd ABN 57 658 320 248. This helpful podcast from Rebus explores mortgages for First Time Buyers and how we make it easier to buy a home. Mortgage lenders routinely use it to assess home loan applicants.

A single person with annual income of 50000 would qualify for a mortgage in the region of 175000 35 times gross income over 30 years. Find out how much you could borrow. How much can a first time buyer borrow.

Feeling That Homeowner Fomo Here Are Some Tips On How To Get Started With The Home Buying Process Home Buying Process Home Buying Home Financing

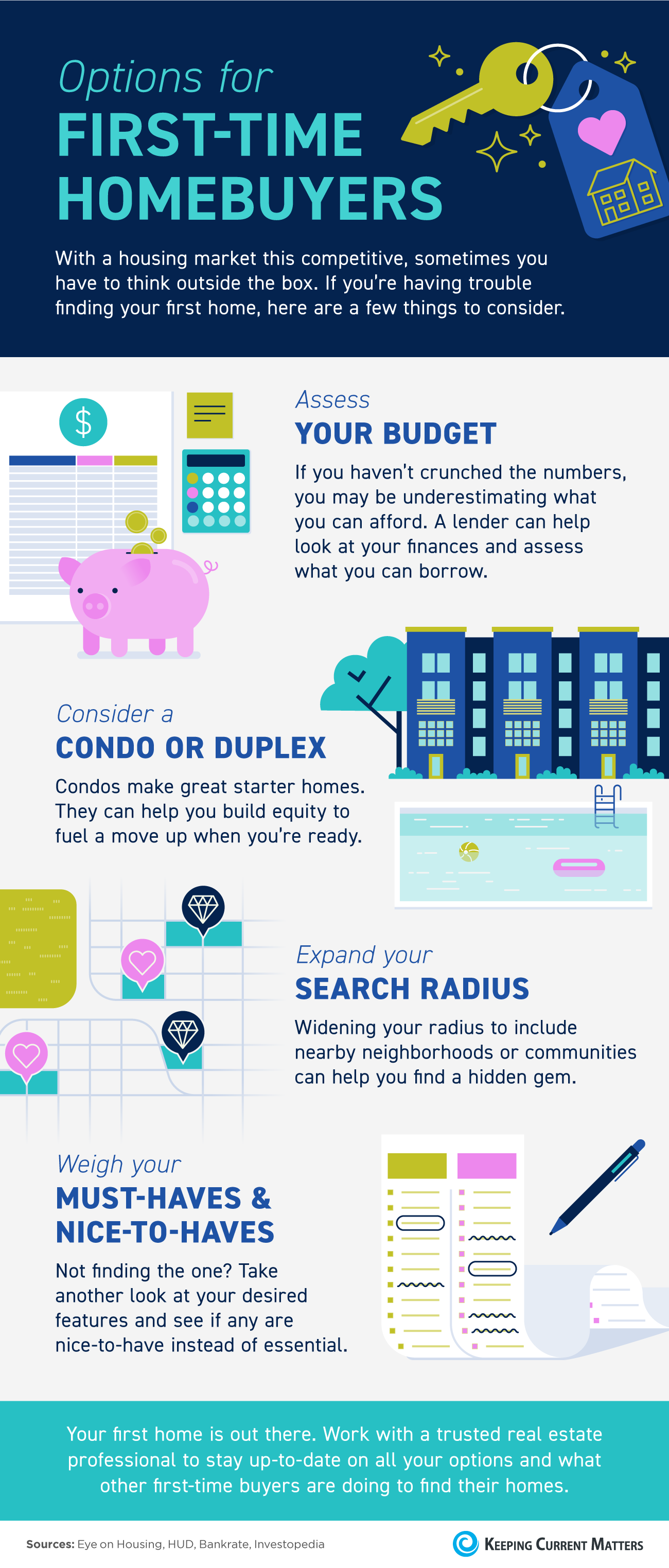

Options For First Time Homebuyers

The Keys To Home Affordability How Much You Can Borrow The Borrowers Real Estate News I Can

Pin On First Time Home Buyers

5 Good Bad Habits Of A First Home Buyer First Home Buyer Buying First Home Buying Your First Home

A Dummies Graphical How To Guide To Getting A Home Loan Home Buying Process Home Improvement Loans Home Mortgage

Creative Finance Lease To Own Rent Home Buying First Home Buyer

3 Linkedin Home Buying Boston Real Estate First Time Home Buyers

Tips For First Time Home Buyers Applying For A Mortgage In 2022 Successful Business Tips Real Estate Quotes Home Buying Tips

Did You Know You Can Borrow For Major Expenses Like Education Expenses Home Renovation Or Weddings Through Ho Home Equity Home Improvement Loans The Borrowers

Great Information For You First Time Homebuyers Qualify For All Four Apply Here Loanfimortgage Com Understanding Mortgages Mortgage Bad Credit Mortgage

As A First Time Home Buyer How Much Can I Borrow Wmc

Real Estate Blog Home Buying Process Process Infographic Home Buying

Casas En Phoenix Foreclosed Casas Remate Subasta De Casas En Phoenix Az Hablamos Espanol 623 First Time Home Buyers First Home Checklist Buying A New Home

Steps To Buying A House Buying First Home Home Buying Tips Home Buying

The Power Of Mortgage Pre Approval Infographic Preapproved Mortgage Mortgage Mortgage Loans

Options For First Time Homebuyers Infographic Keeping Current Matters