Calculate operating margin

The difference is that gross profit is a monetary value and profit margin is a percentage or ratio. An adequate GPM ensures theres enough in the bank to pay for operating costs.

To Prepare An Income Statement Generate A Trial Balance Report Calculate Your Revenue Determine The Co Income Statement Cost Of Goods Sold Statement Template

Contribution margin is a concept often used in managerial accounting to analyze the profitability of products.

. Besides it is a metric to analyze the financial status of a company. Basically your operating margin will show you your earnings from operating activities. 2 Removes Non-Operating Effects.

It is determined by subtracting the cost it takes to produce a good from the total revenue that is made. To calculate the Operating margin we need. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

To interpret this percentage we need to look at other similar companies in the same industry. But it does not account for important financial considerations like administration and personnel costs which are included in the operating margin calculation. This calculator allows the product cost to be built up from its cost components and by entering a retail price will calculate the gross margin percentage and also the markup percentage for each product or product group.

The first one deals with learning gross income. For example a 15 operating profit margin is equal to 015 operating profit for every 1 of revenue. From the above calculation for the gross margin we can say that the gross margin of Honey Chocolate Ltd.

Get 247 customer support help when you place a homework help service order with us. Let us calculate Colgates gross margin. How to Calculate Net Margin Net margin is calculated by taking a companys operating earnings and subtracting interest and taxes then dividing this number by total revenue.

However it does not include debt taxes and other non-operational expenses. The following is the formula used to calculate the operating profit of a company. Read more per unit revenue can be more precise in this context.

Operating Profit Margin differs from Net Profit Margin as a measure of a companys ability to be. Operating margin which is expressed as a percentage is a measure of the revenue left over after accounting for expenses. EBITDA margin calculation removes nonoperating effects that are unique to each company.

Profit margin and gross profit are nearly the same calculation. You can use the following equation to calculate the operating margin of a business. Must contain at least 4 different symbols.

Gross Margin of Colgate. The gross margin represents the percent of total. Operating Profit Revenue - Operating Expenses - Cost of Goods Sold - Other Day-to-Day Expenses eg depreciation amortization etc To use this formula to calculate the operating profit of a business you can use the following steps.

Why Should You Calculate Operating Margin. Let us look at our 1st example. Net profit margin measures the profitability of a company by taking the amount from the gross profit margin and subtracting other operating expenses.

This figure gives you the contribution margin of each unit which tells you how much one unit contributes to the profit. This percentage indicates how much of a companys operating expenses are eating into profits with a higher EBITDA margin indicating a more financially stable company with lower risk. Operating profit margin takes into account all overhead operating administrative and sales expenses necessary for day-to-day business operations.

An operating cash flow margin is a measure of the money a company generates from its core operations per dollar of sales. Gross margin is a companys total sales revenue minus its cost of goods sold COGS divided by total sales revenue expressed as a percentage. How to Use Operating Profit Margin.

Values given in the examples below are in millions. ASCII characters only characters found on a standard US keyboard. For the year ended.

Is 30 for the year. The gross margin equation expresses the percentage of gross profit Percentage Of Gross Profit Gross profit percentage is used by the management investors and financial analysts to know the economic health and profitability of the company after accounting for the cost of sales. Gross profit margin is a financial metric used to assess a companys financial health and business model by revealing the proportion of money left over from revenues after accounting for the cost.

We take Company A and Company B for calculating OP margin. Gross Margin Gross Profit Revenue 100. How to Calculate Gross Profit Margin for a Service Business.

For example if EBIT is 10000 and the tax rate is 30 the net operating profit after tax is 07 which equals 7000 calculation. Consider the below-given income statement for both the companies. Gross Margin Formula Example 2.

Operating Margin Operating IncomeNet Sales Revenue x 100 Operating Income is the EBIT or Earnings Before Interest and Taxes. For example if your unit price is 5 and your unit variable cost is 2 then each unit that you produce will contribute 3 toward profits. Operating profit margin.

If the gross profit margin is unstable. Write down the unit contribution margin. EBITDA margin takes the metric one step further and provides additional insights by calculating the percentage of EBITDA to revenue.

Operating Cash Flow Margin. The margin will show a companys profit as it relates to sales price or generated revenue. The GPM calculation comprises three steps.

While operating margin considers only the cost of goods and operating expenses involved in production net profit margin also factors in the interest and taxes. The operating cash flow can be found on the. So the margin is the percentage of revenue that is gross profit.

The operating profit margin calculation is the percentage of operating profit derived from total revenue. How to Calculate with Example. Operating margin is a margin ratio used to measure a companys pricing strategy and operating efficiency.

10000 x 1 - 03. A single products contribution margin is given with the formula P - V where P is the cost of the product and V is its variable cost the costs associate with resources used to make that item specificallyIn some cases this measure may also be called a. To assist you in calculating a gross margin percentage we have provided a free gross margin calculator available at the link below.

Net Sales Revenue is a companys gross sales minus the cost of returns allowances and discounts. Operating Profit Margin example. Operating Activities includes cash received from Sales cash expenses paid for direct costs as well as payment is done for funding working capital.

Gross Margin 38. 6 to 30 characters long. NOPAT Example.

Calculating gross margin allows a companys management to better understand its profitability in a general sense. Gross profit margin shows how efficiently a company is running.

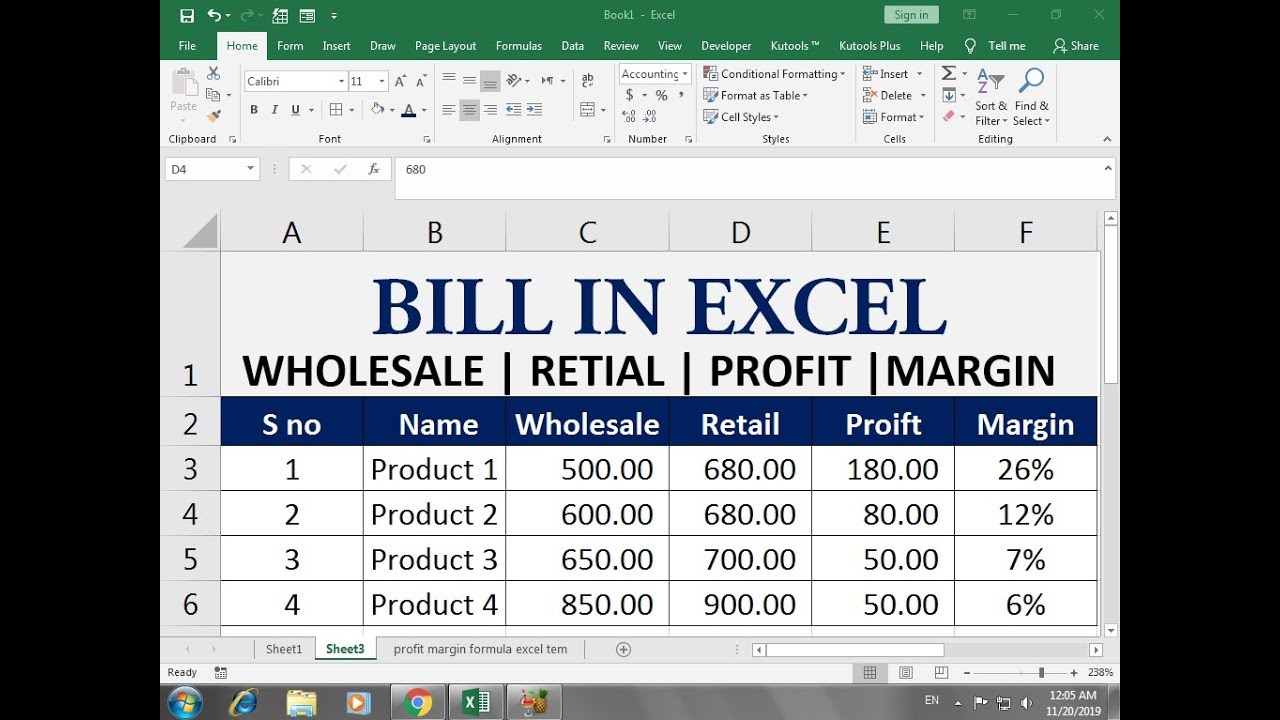

Calculate Profit Margin With Percentage In Excel By Learning Center In U Excel Tutorials Learning Centers Excel

Food Truck Profit Margin Percentage Calculator Plan Projections Starting A Food Truck Food Truck Business Food Cost

Discount Profit Calculator Profit Margin Calculator Excel Etsy Canada In 2022 Calculator Business Template Profit

How To Calculate Net Profit Margin In Excel Net Profit Excel Calculator

The Difference Between Gross Profit Margin And Net Profit Margin Net Profit Profit Company Financials

Easy Turkey Pinwheels Meal Prep Recipe Lunch Meal Prep Meal Prep Meals

I Found This Formulae Very Helpful It Shoes Four Different Ways Of Calculating Degree Of Operating Leverage Also It Breaks Down Contribution Margin Sales Var

How To Calculate Net Profit Margin In Excel Net Profit Profit Excel

Profit Improvement Calculator Plan Projections How To Plan Profit Things To Sell

Gross Profit Vs Net Profit Definitions Formulas Examples Net Profit Accounting Training Profit

Pin On Storage

Techwalla Com How To Calculate Gross Profit Margin Using Excel Techwallacom B07bd92b Resumesample Resumefor Excel Gross Margin Calculator

Product Pricing Calculator Handmade Item Pricing Worksheet Etsy Business Template Pricing Calculator Product Pricing Worksheet

Profitability Strategy To Rocket Your Net Profit Business Development Strategy Profit Margins Business Development Strategy Net Profit Business Development

Break Even Analysis Learn How To Calculate The Break Even Point Financial Analysis Financial Statement Analysis Analysis

Download A Free Recipe Cost Calculator For Excel Which Helps When Calculating Costs Of Ingredients Used In A Recip Food Cost Food Truck Menu Recipe Calculator

Genevieve Wood I Picked This Diagram Because Of The Side By Side View Of The Contribution Margin And Traditional Income Statement I Felt Like You Can Easily S